Even though these expenses don’t impact cash flow (other than taxes), they will impact financial reporting performance (i.e the figures a company reports at the end of the year on their income statement). These expenses typically do not vary with changes in revenue and are mostly constant, at least within the time frame of the operating budget.Īn operating budget often includes non-cash expenses, such as depreciation and amortization. #3 Fixed costsĪfter variable costs are deducted, fixed costs are usually next. Read more about variable and fixed costs. These costs are called “variable” because they depend on revenue, and are often calculated as a percentage of sales. Price (average price, per unit price, segment price, etc.)Īfter revenue, variable costs are determined.Volume (units, contracts, customers, products, etc.).It’s possible to forecast revenue on a year-over-year basis, but usually, more detail is required by breaking revenue down into its underlying components. Revenue is usually broken down into its drivers and components. Each business is unique and every industry has its nuances, but these items are general enough to apply to most industries. The main components of an operations budget are outlined below.

#Cfo budget workbook how to

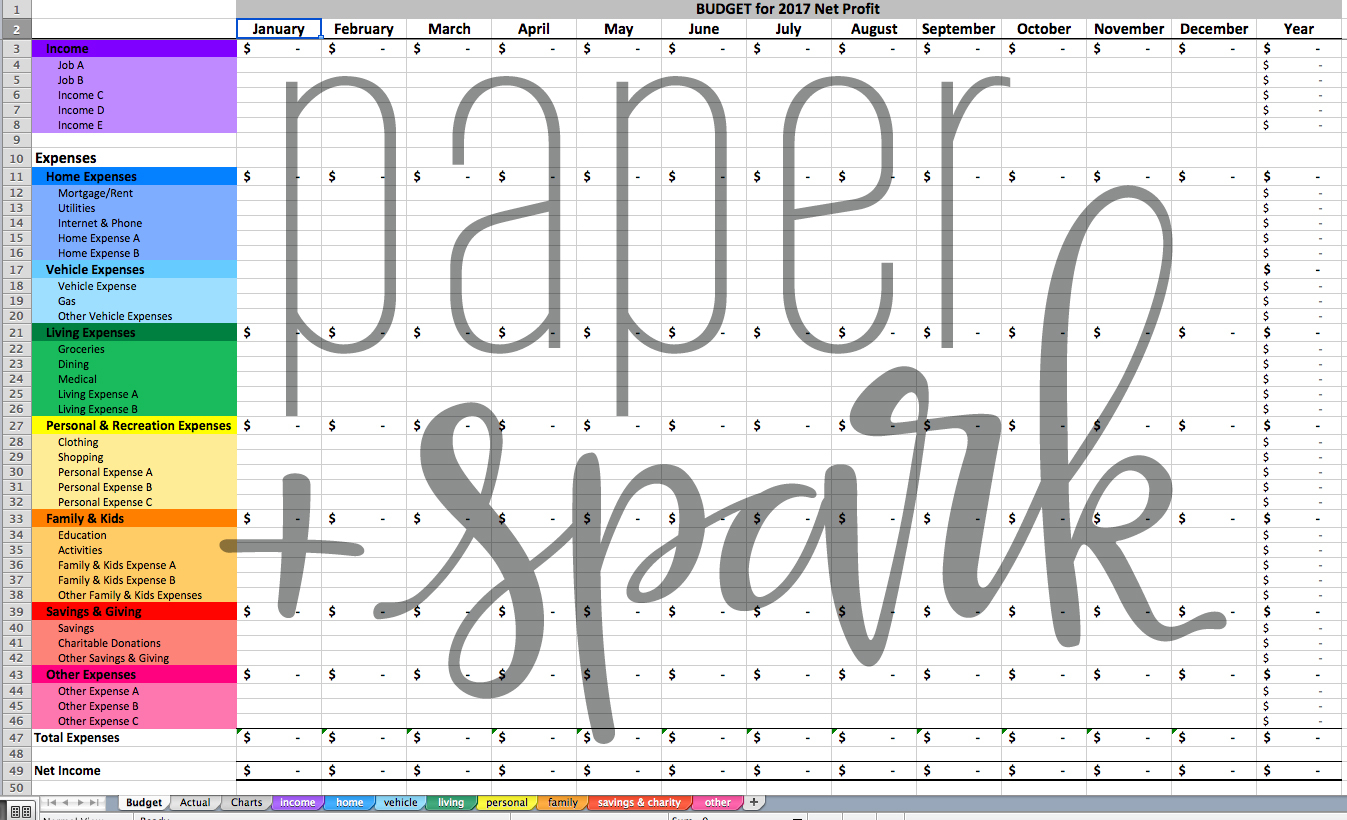

Below is an example of a downloadable budget template and an explanation of how to prepare one.

An operating budget is prepared in advance of a reporting period as a goal or plan that the business expects to achieve. 2017 Budget), or organization uses to plan its operations.

An operating budget consists of all revenues and expenses over a period of time (typically a quarter or a year) which a corporation, government (see the U.S.

0 kommentar(er)

0 kommentar(er)